The Future of Rare Earth Elements: Mining, Processing, and the Race for Technological Dominance

The 17 elements known as Rare Earth Elements (REEs), including neodymium, praseodymium, and dysprosium, are the indispensable building blocks of modern technology.

Despite their name, these elements are not exceptionally rare in the Earth’s crust, but minable concentrations are scarce and their extraction is complex. From high-strength magnets in electric vehicle (EV) motors and wind turbines to advanced military guidance systems, REEs possess unique magnetic, optical, and electrochemical properties that make them irreplaceable.

The global market for these critical materials is accelerating, driven by the clean energy transition and geopolitical competition. The market size, valued at approximately $15 billion in 2025, is projected to reach nearly $30 billion by 2030, underscoring the escalating demand.

A Geopolitical Reality: The Concentrated Global Supply Chain

The global REE supply chain is defined by its extreme concentration, creating significant strategic vulnerabilities for nations reliant on these materials. The overwhelming dominance of a single country is the defining feature of the market.

China’s Continued Supremacy: China remains the undisputed leader in both REE mining and, more critically, the downstream processing and refining stages. According to the U.S. Geological Survey (USGS) and other market analyses for 2024, China’s domestic output of rare earths was approximately 270,000 metric tons, representing about 70% of global production.

Its control over the refining and separation process is even more profound, with the country producing an estimated 87% of the world’s refined REE supply. This near-monopoly is particularly acute for the more valuable and scarcer heavy rare earth elements (HREEs), which are vital for high-temperature applications.

This consolidation is not a matter of chance; it is the result of decades of strategic investment, state-backed industrial consolidation, and an embrace of a less stringent environmental regulatory framework.

While other countries like the United States (from the Mountain Pass mine) and Australia have increased their mining output, they remain heavily dependent on Chinese facilities for refining and turning raw ore into usable components.

This makes the entire supply chain vulnerable to policy shifts and export restrictions.

As of August 2025, China’s government has further tightened its grip by expanding its quota system to include imported raw materials, a move analysts interpret as a strategic effort to limit supply and drive prices higher amid escalating trade tensions.

Driving Demand: The Clean and Digital Revolutions

The demand for REEs is not a static trend; it’s being turbocharged by two global macro trends: the push for a green energy transition and the continuous advancement of digital technologies.

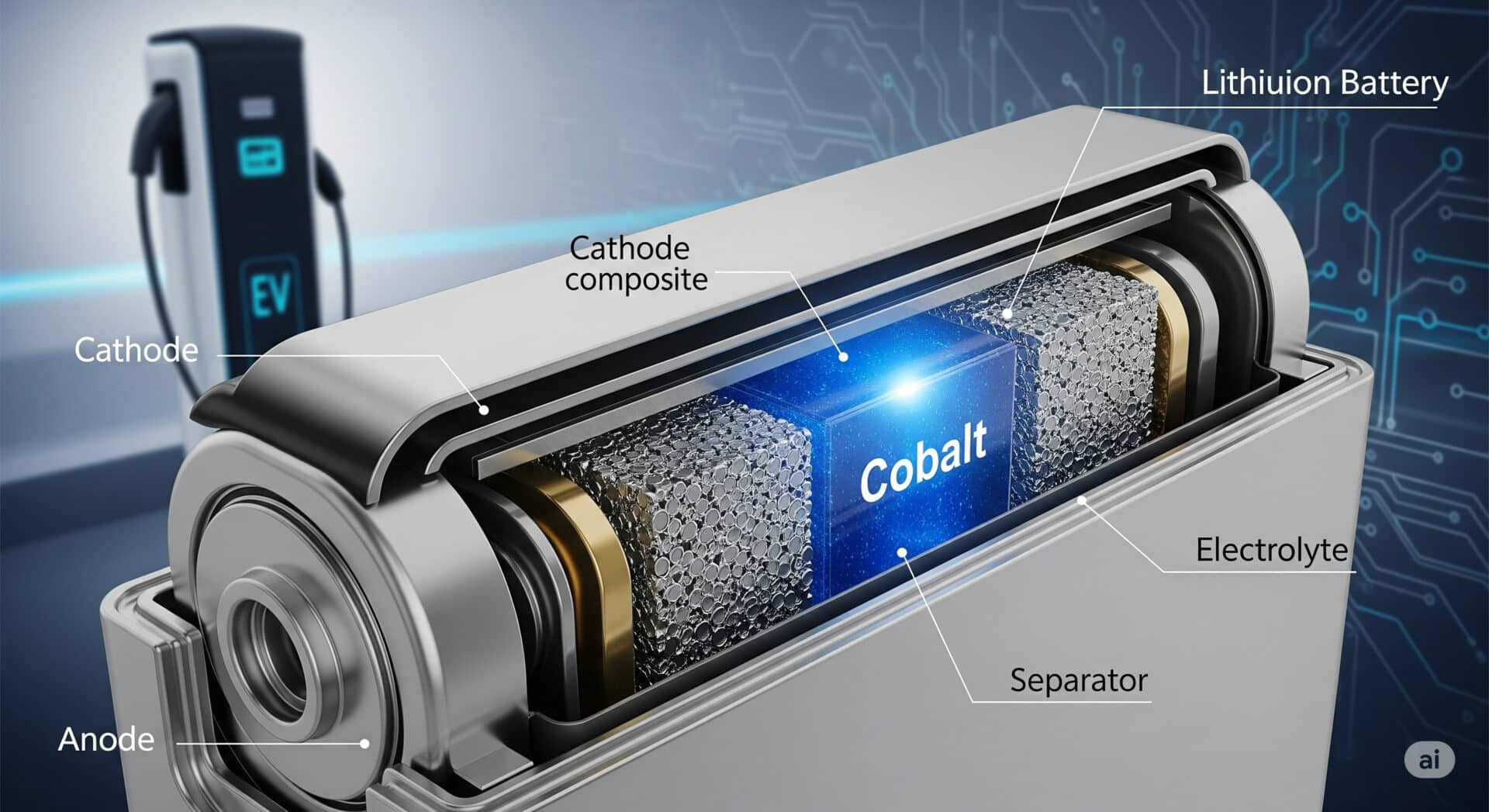

- Electric Vehicles and Wind Power: Permanent magnets made from neodymium and praseodymium are at the heart of EV motors and the direct-drive generators used in large-scale wind turbines. An average wind turbine requires roughly 600 kg of REEs per megawatt of capacity, while an EV can contain 1-4 kg. As governments and industries push to meet ambitious decarbonization goals, the demand for these “magnet REEs” is projected to triple by 2035.

- Consumer Electronics and Defense: Beyond clean energy, REEs are indispensable in a vast array of high-tech products. Gadolinium is used in medical imaging, cerium is a key component in catalysts, and europium and terbium are vital for lighting and display technologies. The defense sector also relies on REEs for mission-critical systems, including stealth technology, precision-guided missiles, and radar.

The robust demand from these sectors ensures the long-term strategic value of REEs, creating a race among nations to secure a stable and independent supply.

The Race for Technological Innovation: Diversifying Away from the Status Quo

In response to supply chain vulnerabilities, a global effort is underway to develop new technologies and alternative supply sources. This push is being supported by significant governmental and private investment, with a focus on improving primary extraction and scaling up recycling.

- Advanced Processing and Separation: New hydrometallurgical technologies, such as those being developed by companies like Ionic Rare Earths, are aimed at creating more efficient, closed-loop systems that reduce chemical usage and environmental impact. This innovation allows for the production of high-purity, separated oxides, which command a premium price for specialized applications in defense and technology.

- A Growing Focus on Recycling: “Urban mining”—the recovery of REEs from end-of-life products like electronics, EV motors, and wind turbine magnets—is gaining significant momentum. While less than 1% of REEs are currently recycled globally, companies are developing new processes like hydrogen decrepitation to directly recover magnet alloys, and advanced hydrometallurgical techniques to extract REEs from scrap. Major players are investing in demonstration plants, with a focus on proving scalability to handle the massive volumes expected from EV battery and magnet recycling in the coming years.

The global rare earth market is at a critical juncture. The undisputed dominance of a single supplier, coupled with soaring demand from transformative technologies, has turned these materials into a strategic flashpoint.

The race for technological dominance is not just about who can build the most wind turbines or EVs, but who can secure the underlying raw materials that power them.

While new mining projects outside of China are gaining traction and groundbreaking processing and recycling technologies are emerging, the transition to a truly diversified and resilient supply chain will take time.

The substantial capital expenditure, lengthy permitting processes, and technical complexities of these projects mean that vulnerabilities will persist for the foreseeable future. The average lead time from a new discovery to a fully operational mine and processing plant can be 10-15 years.

The strategic imperative for nations is clear: invest in domestic and allied mining and processing, foster innovation in new extraction methods, and build a robust “urban mining” infrastructure to future-proof their supply chains.

The U.S. has already implemented a 25% tariff on Chinese rare earth magnets and has engaged in long-term procurement agreements with partners to build a non-Chinese supply chain.

The future of the clean energy transition and technological innovation will be determined by who wins this race for rare earth elements. The global market is bifurcating, with a Chinese-centric ecosystem on one side and a rapidly evolving Western-backed supply chain on the other.